Advertorial

Published by FinanceAdvisors.com | February 21, 2026

Planning for retirement means more than market returns

It’s also about how investments, taxes, and timing work together.

A growing body of research suggests that investors who receive professional, fiduciary guidance may experience greater long-term discipline and tax efficiency (see Vanguard Advisor’s Alpha and Fidelity Tax-Efficient Investing).

Yet one of the most overlooked areas of wealth planning isn’t what you invest in — it’s how your investments are managed after taxes. Even experienced investors can lose meaningful gains each year simply because key tax strategies were never discussed or revisited.

If your advisor hasn’t talked with you about proactive tax planning this year, it may be time to get a second opinion. Take our no-cost Advisor Matching Quiz to get connected with a fiduciary advisor who focuses on education and helps clients integrate taxes into their overall wealth strategy — not just at year-end, but all year long.

1. Ignoring Tax Loss Harvesting

Tax-loss harvesting (TLH) involves selling investments at a loss to offset capital gains. Many investors overlook this approach, leaving potential tax savings unrealized. By systematically harvesting losses, you may reduce taxable income and reinvest proceeds to maintain market exposure.

Research from Vanguard and other sources suggests that TLH may improve after-tax returns by approximately 0.8% to 1.5% per year, depending on individual circumstances. Over time, consistent tax management can meaningfully impact wealth accumulation.

Key Insight: TLH works best as part of a long-term plan guided by a fiduciary who understands your broader financial picture.

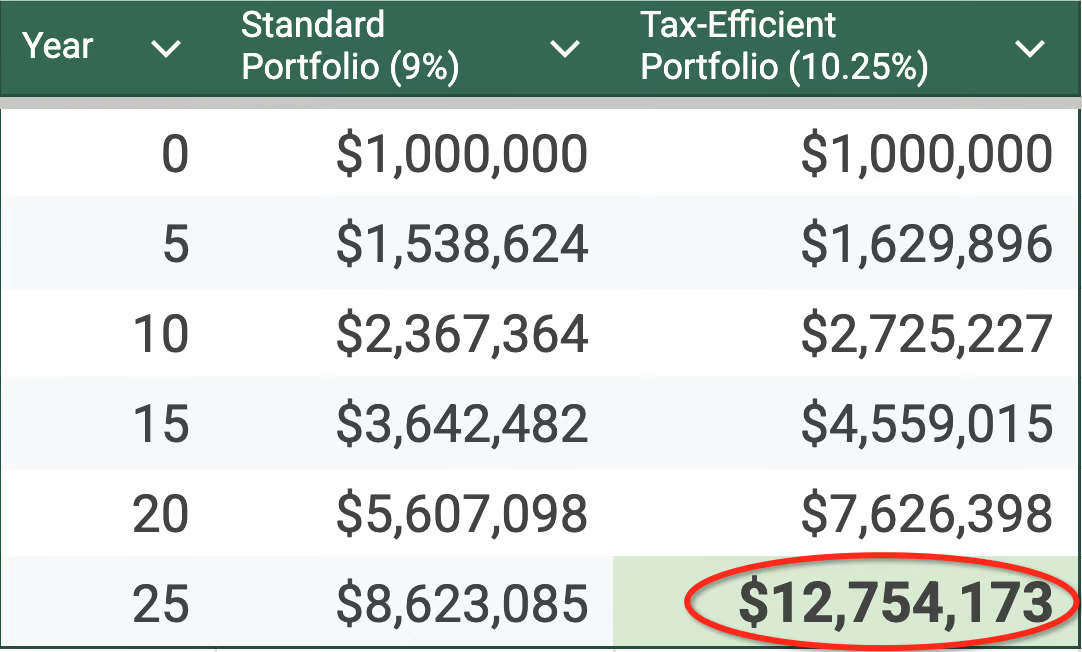

Hypothetical Growth of $1,000,000

Important Disclosures:

The performance figures shown are hypothetical and for illustrative purposes only. They do not represent actual investment results and are not guarantees of future performance.Assumptions include: a starting portfolio of $1,000,000, compounded annually at 9% for the “Standard Portfolio” and 10.25% for the “Tax-Efficient Portfolio.” These rates are not guaranteed and are presented for comparison purposes only. Actual returns will vary and may be higher or lower depending on market conditions, fees, taxes, and other factors.Tax efficiency strategies are highly dependent on individual circumstances and may not be appropriate for all investors. Changes in tax laws or personal tax situations could materially impact results.Past performance is not indicative of future results. All investing involves risk, including possible loss of principal. You should consult a qualified financial advisor and tax professional before making any investment decisions.

2. Poor Asset Location Strategy

Not all accounts are taxed the same way. Placing tax-efficient investments, such as ETFs, in taxable accounts while keeping tax-inefficient assets, such as bonds and REITs, in tax-advantaged accounts can significantly reduce your tax liability.

Key Insight: Coordinating account types can improve efficiency without changing your investments. It’s about where you hold them, not just what you hold.

3. Holding Mutual Funds in Taxable Accounts

Mutual funds can be tax-inefficient due to capital gains distributions even when you don’t sell shares. This may create avoidable tax burdens. Some investors address this by using ETFs or direct indexing to gain greater control over tax timing.

Key Insight: Evaluate whether your accounts and investment types are aligned for tax efficiency.

Art as a representation of alternative asset strategies

Photo: This is the photo source

4. Sticking with ETF's Instead of Moving to Direct Indexing

ETFs tend to be more tax-efficient than mutual funds, while direct indexing may offer additional flexibility. It allows investors to own individual securities for more precise tax-loss harvesting and customization.

Key Insight: Direct indexing helps manage tax liability and is a tactic commonly used to by high-net worth families. Interested? Connect with a fiduciary advisor to discuss direct index investing in service of your overall portfolio strategy.

5. Overlooking Tax Lots in Securities Transactions

Tax-lot optimization helps minimize gains when selling securities. Choosing lots with the highest cost basis can lower taxable income. Many investors—and some firms—don’t systematically apply this approach.

Key Insight: Even small details like cost-basis management can add up over decades. A fiduciary advisor can help ensure your plan reflects both precision and purpose.

Why These Mistakes Matter

Taxes can quietly erode returns just as much as poor investment decisions.

Many investors assume their advisor is already optimizing for taxes, but not every advisor integrates tax planning as part of ongoing strategy.

If you have not discussed these strategies recently, it may be time to start. The difference between a reactive and proactive approach can compound for years to come.

Take our no-cost Advisor Matching Quiz to get matched with a fiduciary advisor who leads with education and helps clients build coordinated, tax-aware plans for the years ahead.

These conversations are not about chasing returns, they are about clarity, confidence, and control.

Click Your State to Get Matched With a Financial Advisors Who Serve Your Area

After you choose your state and answer a few questions, you will get instantly matched a fiduciary.

Common tax blunders could be costing you up to 48% of your wealth. Speak with a financial professional to understand potential implications for your specific situation.

At Finance Advisors, your trust is of utmost importance to us. FinanceAdvisors.com is a complimentary online platform offering valuable content and comparison tools to our visitors. In order to maintain our commitment to providing 100% free resources for consumers, FinanceAdvisors.com seeks collaborations with select companies featured on this page, potentially receiving marketing compensation in return for clicks and inquiries generated from our site. This compensation may influence the positioning and sequence of these companies on our page. Please note that the arrangement of these listings, their order, and company ratings can be subject to modification based on editorial judgments. This does not include all available offers. Our collaborative financial partners include, but are not limited to: SmartAsset, Wiser Advisor, Datalign Advisors, Accredited Debt Relief, Even Financial, Red Ventures, JG Wentworth, Turbo Debt, FinanceBuzz, Everquote, and more.